The tech world universally anticipates the release of a new Gartner Magic Quadrant, and this year’s CCaaS edition is no different.

There are several surprising and compelling narratives behind Gartner’s analyses this year — underpinned by the firm’s assertion that the CCaaS market continues to grow at a double-digit pace.

So what are the essential takeaways from the 2023 CCaaS Gartner Magic Quadrant?

What are the Key Factors Behind the CCaaS Market’s Expansion?

Vendors increasingly leverage large language models (LLMs) into their systems, with AI automating or streamlining workflows to boost productivity and performance. Refined best practices and tailored agent training are influencing improvement in agent experiences, while better systems are in place to manage “peaky” contact volumes.

Companies are building increasingly sophisticated customer experience strategies, and the market is maturing, with several key companies leading the charge. Speaking of those market leaders…

Amazon Becomes a Leader

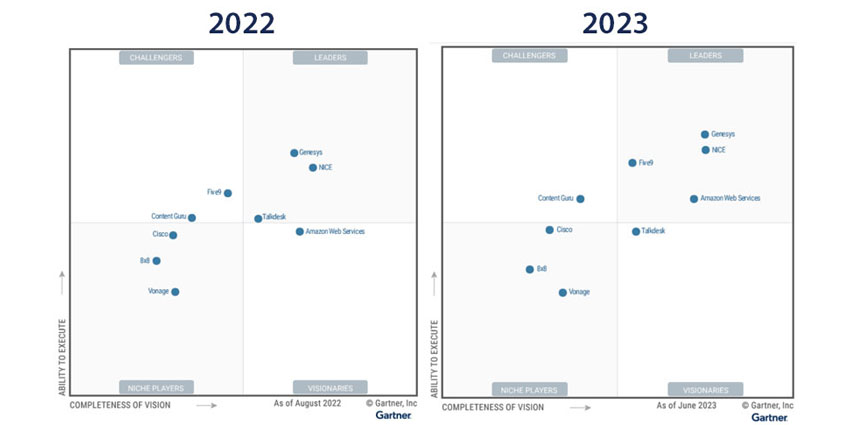

After placing as a visionary in 2022, Amazon has entered the leader quadrant thanks to its significant investment and innovation in CCaaS and compelling pricing structure.

Gartner describes Amazon Connect’s pricing model as “the most agile in the CCaaS market” because customers only pay for the seats and capabilities they leverage.

Gartner also observes that AWS has developed a substantial network of development partners to offer pre-built solutions as alternatives to what customers could assemble separately.

Amazon’s contact centres can trial new feature sets in a test environment without being tied to long-term commitments, which fosters omnichannel experimentation and innovation.

Five9 Moves Over

Five9, too, has entered the leader quadrant following a sustained position as a challenger.

Gartner pinpoints its enterprise deployment growth as a critical factor behind finally achieving leader status. Five9 underwent a major global expansion and now systematically implements CCaaS products across service operations featuring thousands of agents across its ecosystem.

Gartner registered Five9’s AI competency as a highlight attraction for the company’s enterprise customers, illustrating Five9’s holistic capacity for many use cases across different verticals.

Gartner also highlighted that Five9’s customer base routinely praises the vendor’s post-sale support, creating additional value from the solution.

Talkdesk Drops out of Leader Quadrant

Talkdesk has dropped out of the leader quadrant for the first time in four years.

Gartner positively highlighted Talkdesk’s sustained growth curve, with its attractive prices and innovative functionality contributing to the growing number of enterprise customers signing up. However, Gartner underlined cautions in its sales and service operations outside of Europe and the US as the primary factor behind its drop out of the Magic Quadrant.

There are plenty of other intriguing developments, of course.

Genesys might have consolidated three CCaaS platforms into one over the past year, but interestingly, Gartner did not see that as hampering its leader status. Its “strong revenue growth” persists as a core strength for Genesys, allowing it to direct funds into public cloud research and development (R&D) and its ongoing expansion.

NICE has placed high in the leader quadrant again. Yet, despite the vendor’s expertise and product quality in these areas, NICE’s workforce engagement (WEM) or robotic process automation (RPA) are not mentioned as critical market differentiators.

Then there are the high-profile omissions, such as Zoom, Avaya, Microsoft and Salesforce — what was the cause behind their absence?

All this is explored in detail below.

from UC Today https://ift.tt/foJmYB9

0 Comments